Franchise Tax Board (FTB) Info & Services: [Your Guide]

Are you prepared for the complexities of tax season, or do the words "franchise tax board" send a shiver down your spine? Navigating the landscape of California state taxes, especially when interacting with entities like the California Franchise Tax Board (FTB), demands a meticulous understanding of regulations, deadlines, and the various forms you might encounter.

The California Franchise Tax Board (FTB) plays a pivotal role in the financial ecosystem of the state, acting as the primary administrator and collector of state personal income tax as well as corporate franchise and income tax within California. As a crucial component of the California Government Operations Agency, the FTB shoulders the responsibility of ensuring the financial health of the state through the efficient collection and administration of taxes. Its sphere of influence extends to a wide array of taxpayers, from individual earners to large corporations, making it a vital link in the chain that funds vital state services.

The FTB collaborates with a network of partner agencies to ensure the seamless operation of its various functions. These partner agencies are: the Board of Equalization, the California Department of Tax and Fee Administration, the Employment Development Department, the Franchise Tax Board, and the Internal Revenue Service. This collaborative framework enables the FTB to share information, coordinate efforts, and provide comprehensive services to taxpayers and businesses throughout the state.

When dealing with the FTB, you may encounter various scenarios that require specific actions. For example, if you are a business entity, you might need to apply for an "Entity Status Letter." Corporations and limited liability companies (LLCs) are eligible for this letter, which provides official confirmation of their standing with the state. However, it is important to remember that changes to your entity's name, made through the Secretary of State, may take up to 30 days to be updated in the FTB's records.

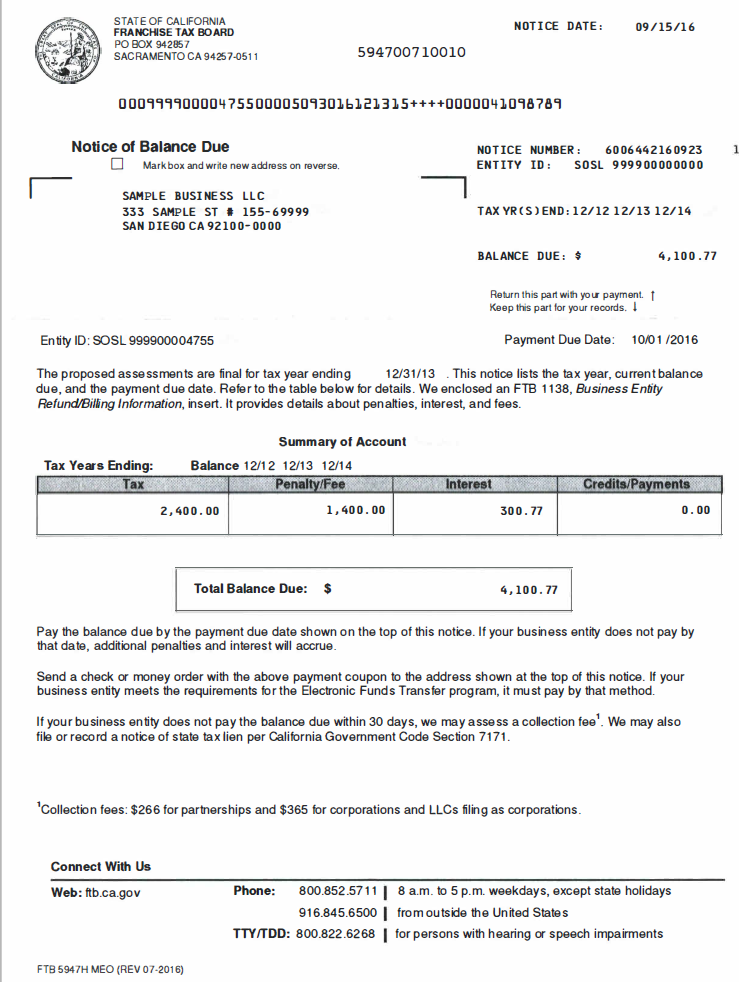

The FTB website provides a wealth of information and resources to help taxpayers. If you receive a notice from the FTB asking you to file a California tax return, the website offers guidance on how to proceed and assists in resolving any questions you may have about the notice. For example, you may be prompted to select your entity type and enter your entity ID to access specific services.

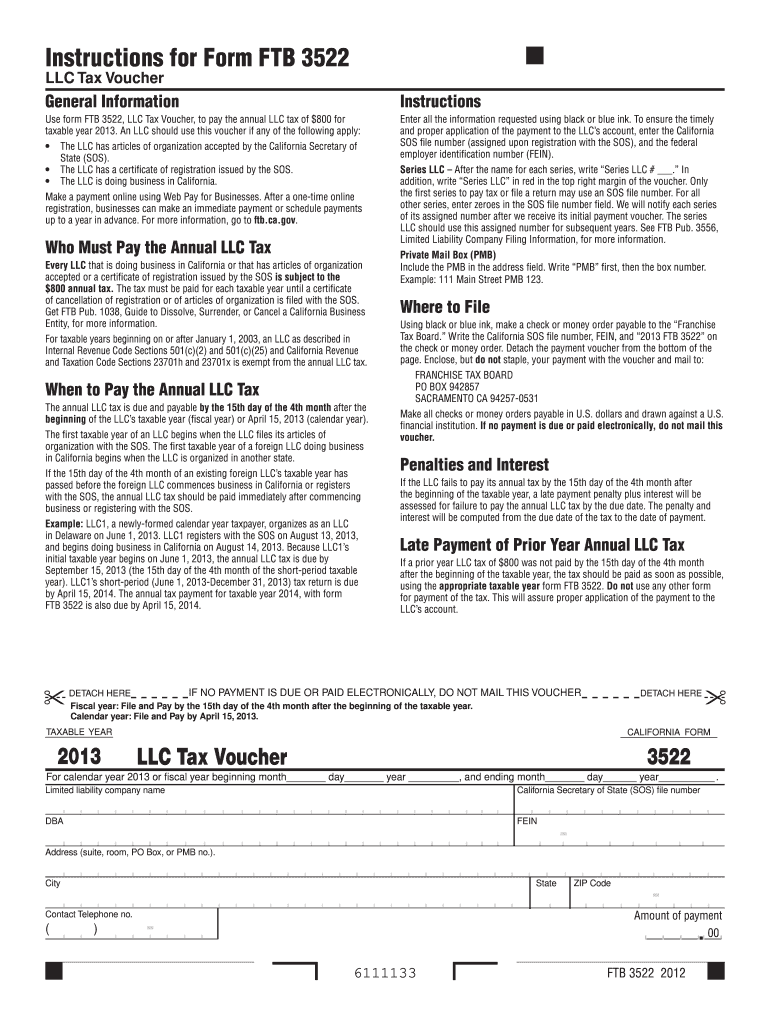

If you are an LLC, you should be aware of the estimated fee requirement. Use the "Estimated Fee for LLCs (FTB 3536)" to make your estimated fee payment. Failure to make this payment by the original return due date will result in penalties and interest.

For those using the FTB website, keep in mind that the Google translation feature is provided for general informational purposes only. For official business, always consult a qualified translator. The FTB is committed to providing accessible services. The website's certification date of July 1, 2023, reflects its commitment to accessibility and compliance with California Government Code sections 7405 and 11135.

MyFTB is another valuable resource. It offers individuals, business representatives, and tax professionals access to tax account information and services. Here, you can file a return, make a payment, or check your refund. You will need to log in to your MyFTB account to access these services. Links to popular topics and online services are provided to streamline your experience.

Here's a table outlining essential information related to the California Franchise Tax Board (FTB):

| Category | Details | Notes |

|---|---|---|

| Overview | The California Franchise Tax Board (FTB) is the primary state agency responsible for administering and collecting California's personal income tax and corporate franchise and income tax. | Part of the California Government Operations Agency. |

| Primary Functions | Administers and collects state taxes, including personal income tax, corporate franchise tax, and corporate income tax. | Ensures the financial health of the state through efficient tax collection. |

| Partner Agencies | Board of Equalization, California Department of Tax and Fee Administration, Employment Development Department, Franchise Tax Board, Internal Revenue Service. | Collaborates to share information and coordinate efforts. |

| Entity Status Letter | Available for corporations and limited liability companies (LLCs). | Provides official confirmation of entity status. |

| Name Changes | Changes to entity names made through the Secretary of State may take up to 30 days to be reflected with FTB. | Be aware of processing times. |

| Estimated LLC Fee | Use "Estimated Fee for LLCs (FTB 3536)" to remit estimated fee payments. | Avoid penalties and interest by meeting the original return due date. |

| Website Resources | Provides information to assist with filing a tax return and resolving questions about notices. | Offers services to file a return, make a payment, or check your refund through MyFTB. |

| MyFTB | Provides access to tax account information and services for individuals, business representatives, and tax professionals. | Requires login for access. |

| Translation Feature | Google translation feature available for general information only. Consult a translator for official business. | For general informational use only. |

| Accessibility | FTB website is designed, developed, and maintained to be accessible. Certified as of July 1, 2023. | Complies with California Government Code sections 7405 and 11135. |

| Important Forms | 2024 instructions for Form 568, Limited Liability Company Return of Income. | Refer to the Internal Revenue Code (IRC) as of January 1, 2015, and the California Revenue and Taxation Code (R&TC). |

| Contact Information | Accessible Technology Program. | Contact for accessibility-related inquiries. |

| Security Measures | Requires specific combinations of information (e.g., entity type and ID, social security number and last name) to access services, ensuring that the combination matches records. | Protects taxpayer data and prevents unauthorized access. |

| Additional Services | Offers the ability to submit a certificate of revivor application and use tax calculators to figure tax. | Convenient tools available for taxpayers. |

For further information, consult the official California Franchise Tax Board website.

If you are dealing with specific forms, such as the 2024 Form 568, Limited Liability Company Return of Income, it's crucial to consult the detailed instructions. These instructions often reference the Internal Revenue Code (IRC), and the California Revenue and Taxation Code (R&TC) as of specific dates, such as January 1, 2015. The reference to these codes underscores the legal and regulatory framework that governs California's tax system.

Navigating the FTB website requires careful attention to detail. You'll frequently be prompted to enter specific information. For example, to access certain services, you may need to enter your Social Security Number and last name, ensuring that the combination matches the records on file. This measure is a security protocol that protects your information and maintains the integrity of the FTB's services. The website also includes fields marked as "required," indicating the essential information needed to complete your tax tasks.

Should you need to calculate your tax obligations, the FTB provides calculators, such as the one that helps determine your California taxable income from Line 19 of Form 540 or Form 540NR. These calculators often have specific limitations. For example, some may not compute taxes for Form 540 2EZ, advising users to refer to the 540 2EZ tax tables for those situations.

Another aspect to be aware of is the refund process. When you claim a refund on your 2024 California tax return, the website may ask for the refund amount in whole dollars, without special characters. This detail is a practical step in streamlining the information input and ensuring accuracy in processing your return.

Beyond the specifics of filing and payments, the FTB offers valuable services like the "File directly with us for free" option. This service provides a convenient and cost-effective method for individuals and businesses to fulfill their tax obligations. Keep in mind that the FTB's website is designed to be user-friendly, and it is regularly updated to reflect the latest tax laws and regulations.

For those who are more comfortable in Spanish, the FTB provides a Spanish language version of its website. This effort ensures that a wider range of Californians have access to the information and resources they need. The presence of both English and Spanish versions highlights the FTB's commitment to inclusivity and accessibility. The FTB also provides updates, as of January 15, 2025, to ensure content reflects the most current information.

The FTB's commitment to accessibility is evident in its efforts to ensure that its website complies with California government regulations. Their certification, as of July 1, 2023, is a testament to their ongoing dedication to making the website usable by all, including those with disabilities. In the ever-changing landscape of tax regulations, staying informed and making use of the resources provided by the FTB is essential to fulfilling your tax obligations accurately and efficiently.