DRS Accounts: Your Guide To Online Access & Retirement Benefits

Are you a Washington State public employee or retiree seeking clarity on your retirement plan? Accessing and managing your retirement account information online through the Washington State Department of Retirement Systems (DRS) is a secure and efficient way to stay informed and in control of your financial future.

This site offers online account services designed specifically for the members and retirees of the Washington State Department of Retirement Systems. Through this portal, you can access vital investment account information for Plan 3 participants, as well as those enrolled in the Deferred Compensation Program. This digital gateway allows you to manage your retirement benefits conveniently and securely. To learn more about how to navigate this platform, take a look at the "online account access" section.

Whether you're a current member or a retiree in any DRS pension plan, the platform provides a secure environment for you to access your retirement account online. Setting up and activating your account is a straightforward process, taking only a few minutes to complete. This streamlined accessibility is a significant advantage in today's fast-paced world.

For those who are actively employed, the online account offers a range of functionalities. You can view detailed account information, update beneficiary designations to ensure your wishes are met, and send secure messages directly to DRS. The system empowers you to make many changes and requests directly through your online account, giving you greater control over your retirement planning.

Should you need further assistance or have specific inquiries, a "contact us" tool is available, connecting you with a retirement specialist who can provide personalized guidance. The Washington State Department of Retirement Systems is committed to providing its members and retirees with the necessary resources and support.

To further protect your personal information, the system automatically logs you out of your account after a period of inactivity. This security measure is an essential aspect of safeguarding your sensitive data.

For general inquiries or specific questions, you can contact the Washington State Department of Retirement Systems (DRS) by phone, the contact information is available at the DRS website. The DRS website serves as a comprehensive hub of information and resources, covering many topics related to retirement planning, including when you are eligible to retire and how to obtain an official estimate of your benefits when you're within six months of retirement. It also provides vital information about handling life events like a divorce, that may impact your retirement plan.

Through the DRS record keeper, Voya Financial, you can log in directly to your DCP, Plan 3, or JRA retirement accounts, simplifying the management of your retirement savings. If you don't have a DRS pension account, theres a dedicated login for you as well.

Did you receive a PIN letter? This important document contains a personal identification number and is the starting point for setting up your online access. If you have received the PIN letter, follow the simple steps to create your account.

For employers who participate in the retirement systems provided by DRS, this site also offers a dedicated area for online resources. This section provides employers with the tools and information needed to administer the retirement plans effectively. With Multi-Factor Authentication (MFA), youll receive an authentication code sent to the email address or mobile phone number registered in your account, ensuring the security of your account.

The Deferred Compensation Program (DCP) is an IRC Section 457 plan administered by the Washington State Department of Retirement Systems (DRS). DCP is similar to a 403b program, providing a valuable avenue for retirement savings. The DCP adheres to the administrative codes and rules adopted by Washington agencies.

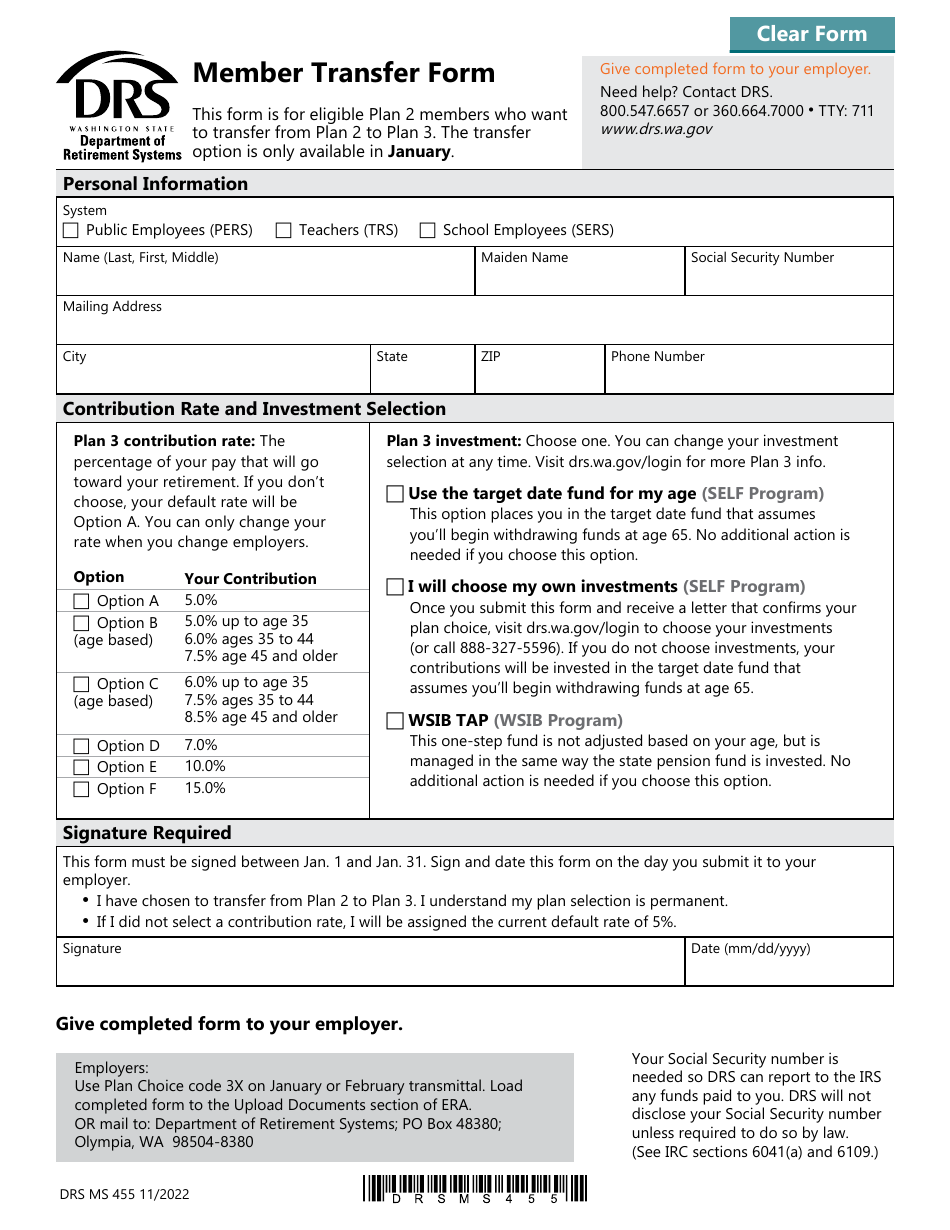

For any forms that need to be submitted, they can be sent to the DRS mailing address. This offers an efficient and reliable channel for communication.

This system makes it easy to navigate through the options for Plan 3 Tap Annuity purchase.

This site offers online account services for members and retirees of the Washington State Department of Retirement Systems, providing access to investment account information for Plan 3 and the Deferred Compensation Program. To find out more, see online account access.

For employers participating in retirement systems provided by DRS, the site provides access to online resources. This dedication to providing resources to both members and employers showcases the broad approach that DRS takes.

DRS offers free, live webinars to help you plan for financial independence, which is crucial for securing a comfortable retirement. These webinars provide valuable insights and strategies.

The Washington State Patrol Retirement System (WSPRS) is also part of the range of retirement systems provided by DRS, serving specific public servants.

The Department of Retirement Systems serves a diverse population of over 330,000 Washington public employees, including firefighters, teachers, and police officers. DRS, led by Tracy Guerin and supported by the DRS Advisory Committee, manages one of the most complex public retirement systems in the country. The system is made up of 15 plans that are spread across eight individual retirements. DRS provides services to over 300,000 current and former Washington State employees.

DRS values its strong partnerships with employers. These partnerships are critical to effectively providing services to retirement system members. DRS also understands and appreciates the important contributions employers make. The DRS understands these contributions are vital to their work for two main reasons:

The DRS record keeper, Voya, calculates this Required Minimum Distribution (RMD) and pays it to you automatically each year. You can also take out your own withdrawals to meet the minimum.

Completing the annual minimum withdrawal, either on your own or automatically through the record keeper, helps you avoid the tax penalty (up to 25%). This is an important aspect of managing your retirement finances.

The Washington State minimum wage is adjusted each year. As of January 1, 2024, the minimum wage is $16.28 per hour; which means 90 times the Washington State minimum wage is $1,465.20 per month.

While DRS doesnt charge fees for rollover services, your other financial institutions could. It is always wise to check with each financial institution to understand if fees will be applied.

The (Washington State Patrol) PSERS 2 PSERS Plan 2 (Public Safety). The Washington State Patrol Retirement System is just one of the several plans managed by the Department of Retirement Systems. These plans are all important aspects of the DRS.

This page provides answers to commonly asked questions about logging in and registering for online account access. Having easy access to information is a key step in planning your retirement.

If your survivor passes before you, you can have your benefit changed to the unreduced single amount. Informing the DRS of any life changes is important to ensure your benefits are accurately administered.

DRS will automatically log you out of your account after a period of inactivity in order to protect your personal information. This security measure is an essential aspect of safeguarding your sensitive data.

All DRS provided annuities provide a balance refund. This means that if you and any named survivors die before your original purchase amount is paid out, your beneficiaries will receive the remaining amount. This feature offers peace of mind.

The payments you receive from DRS annuities are taxed as income. It's important to understand how annuities affect your taxes as part of your overall financial planning.

The Washington State Department of Retirement Systems (DRS) has released the annual Cost of Living Adjustment (COLA) amounts for retirees in plans 2 & 3 of PERS, SERS, TRS, and PSERS. This adjustment helps to maintain the purchasing power of your retirement income.

DRS also has information on careers, with job opportunities and available positions. See all available DRS positions at careers and apply. You can also sign up for email updates to get an email or text alert when a new DRS position is available.

Purchasing service credit earned outside the Washington State Teachers' Retirement System can impact your retirement benefits. The Public Education Experience Program (TRS Plan 3) will impact how you prepare.

This site provides online account services for members and retirees of the Washington State Department of Retirement Systems, providing access to investment account information for Plan 3 and the Deferred Compensation Program. To find out more, see online account access.