FTB Information & Updates: California Franchise Tax Insights!

Are you prepared for the intricacies of franchise tax compliance, especially in a landscape that is constantly changing? Understanding the nuances of these regulations, particularly in states like California and Oklahoma, is crucial for businesses of all sizes to avoid costly penalties and ensure smooth operations.

The California Franchise Tax Board (FTB) plays a significant role in ensuring that businesses operating within the state adhere to tax laws. As of July 1, 2023, the FTB website's accessibility was certified, demonstrating a commitment to providing accessible online services. This certification indicates compliance with California Government Code sections 7405 and 11135, highlighting the state's dedication to digital inclusion. This means the website is designed, developed, and maintained to be accessible to individuals with disabilities.

The Franchise Tax Board (FTB) website, last updated on January 15, 2025, provides various resources and services. These include tools to search for a franchise tax account status, as well as information about the department itself. The website offers more contact information and descriptions of available services.

For businesses in Oklahoma, the landscape has shifted. The franchise tax was eliminated as part of a comprehensive tax reform plan. Tax year 2023 marked the final year for filing franchise tax returns in Oklahoma.

If you're navigating the California tax system, consider these key points. Taxpayers who paid $500,000 or more for any specific tax are required to transmit payments using TEXNET. If your payments reach $10,000 or more, it's essential to comply with the state's payment guidelines. You can also use the FTB website to find information on your franchise tax account status; this is a summary designed to address your business needs. If you have questions, the website's Frequently Asked Questions (FAQ) section can provide more insight.

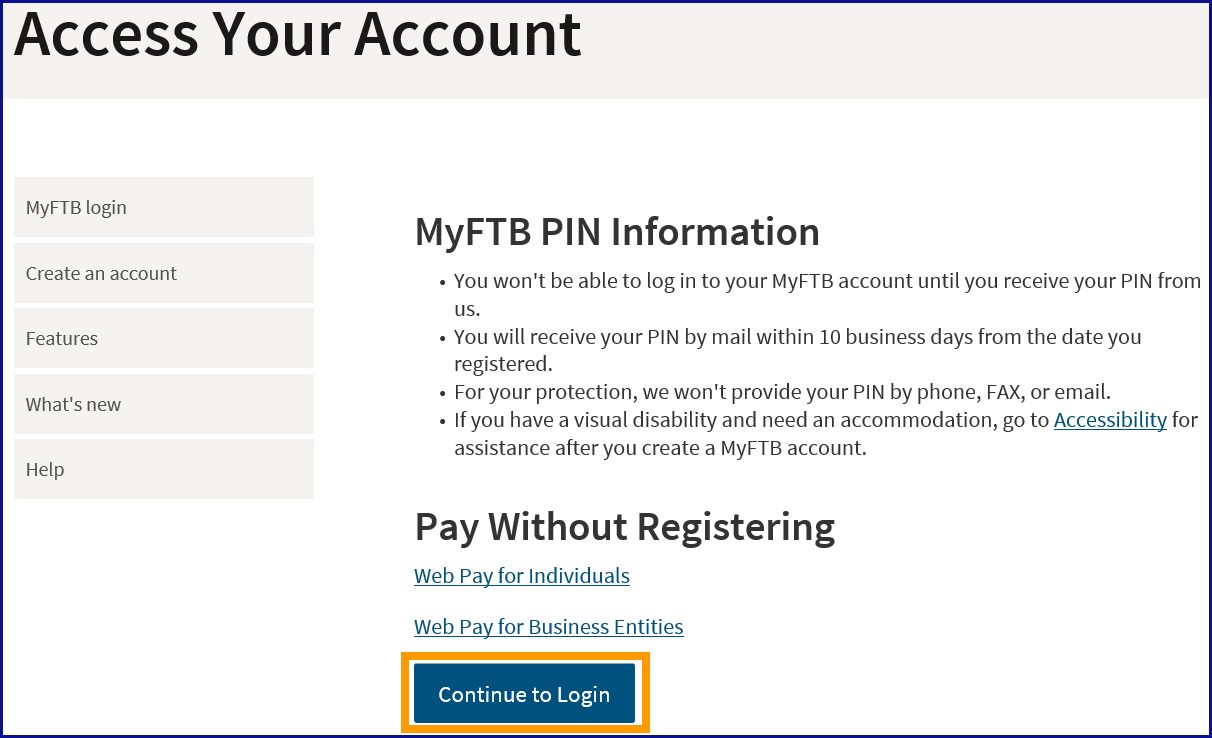

For those needing to access their MyFTB account, you can log in and find links to popular topics and online services. To access specific services, you'll typically need to enter your social security number and last name. The combination must match the records to access the service.

For the 2024 tax year, when calculating your California taxable income, you'll typically enter the amount from line 19 of Form 540 or Form 540NR. However, the tax calculator might not calculate tax for form 540 2EZ; for this, youd have to use the 540 2EZ tax tables available on the tax calculator, tables, and rates page.

Navigating the California Franchise Tax

The California Franchise Tax Board (FTB) plays a critical role in the state's financial ecosystem. This involves overseeing and administering the franchise tax, which is a levy on corporations and other entities that are granted the privilege of doing business in California. Understanding the intricacies of this tax is essential for businesses to remain compliant and avoid potential penalties. It's not just about paying taxes; it's about understanding the framework that supports the state's economy.

For businesses to avoid challenges, it is important that they understand the regulations. The FTB's website serves as a main hub for a wide array of resources. As of July 1, 2023, the FTB's website accessibility was certified. The FTB demonstrates a commitment to providing accessible online services to all. This certification signifies that the website adheres to California Government Code sections 7405, 11135, and other relevant statutes. The website is designed, developed, and maintained with accessibility in mind.

The FTB's website, last updated on January 15, 2025, offers several features. It provides a franchise tax account status search tool. It also includes other vital information about the department and its many services.

This certification indicates that the website is designed, developed, and maintained to be accessible, adhering to the guidelines outlined in California Government Code sections 7405 and 11135. These codes emphasize the importance of ensuring that state-run websites and digital resources are usable by everyone, including individuals with disabilities. This commitment to accessibility is a legal and ethical obligation and is fundamental to the inclusivity of the online environment.

For businesses that need to access specific services, authentication is frequently required. This usually involves entering your social security number (SSN) and last name. It is important to remember that the information entered must exactly match the records in the system to get successful access. When entering your SSN, which is required, make sure to enter the nine numbers without spaces or dashes.

Here is a table summarizing key aspects of the California Franchise Tax:

| Aspect | Details |

|---|---|

| Tax Type | Franchise Tax (levied on corporations and other entities) |

| Governing Body | California Franchise Tax Board (FTB) |

| Purpose | Tax imposed for the privilege of doing business in California |

| Website Accessibility | FTB website certified as accessible as of July 1, 2023, compliant with California Government Code sections 7405 and 11135 |

| Website Features | Franchise tax account status search, department information, contact details |

| Payment Threshold (TEXNET) | Payments of $500,000 or more for any specific tax |

| Payment Threshold (General) | Payments of $10,000 or more |

| Authentication | Requires Social Security Number (SSN) and last name for certain services; the combination must match FTB records |

| Tax Forms Reference | For 2024, use line 19 of Form 540 or Form 540NR for California taxable income |

For comprehensive information and to access various resources, always refer to the official FTB website. This is the most reliable and up-to-date source for all tax-related information and services.

In conclusion, the California Franchise Tax Board (FTB) remains a key component of the state's tax system. The FTB website provides critical resources and is committed to digital accessibility and compliance with the law. Businesses must stay informed to remain compliant and navigate the tax landscape effectively.